Fbt Health Insurance

This document is a simplified version for special audiences. Only about a third of New Zealanders currently have healthcare insurance and the number of employer group schemes is very small.

Fringe Benefit What Is Fringe Benefit Any Good

Fringe Benefit What Is Fringe Benefit Any Good

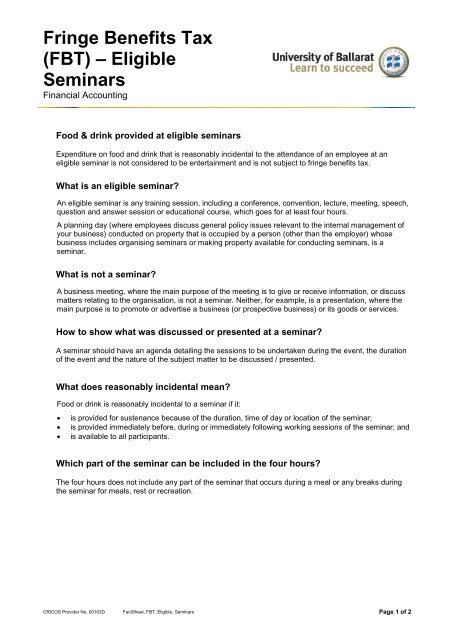

Fringe Benefits Tax FBT fact sheet.

Fbt health insurance. Smartsalary recommends that you do not salary package this item. Employers must self-assess the amount of fringe benefits tax FBT they have to pay when lodging their FBT return at the end of each FBT year 1 April to 31 March. Health Insurance - the reimbursement or payment of employee or associates health insurance premium will be subject to FBT.

This is different. HELP the reimbursement or payment of employee HELP is subject to FBT. When you package this item Smartsalary will after the end of the FBT year 31 March deduct an additional pre-tax amount equivalent to the amount you are packaging multiplied by 8868 to offset the FBT.

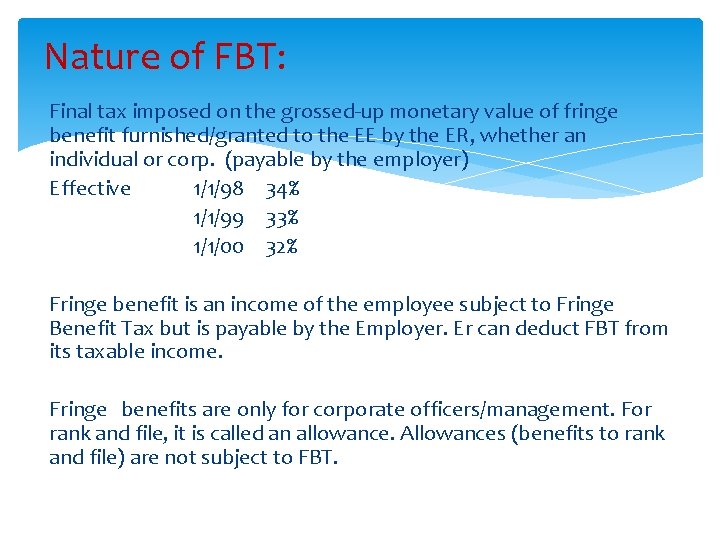

Te tāke painga tāpiri. 11292018 Section 33B10 of the Tax Code expressly provides that life or health insurance premiums and other non-life insurance premiums or similar amounts in excess of what the laws allow are subject to FBT. LCT inclusive basis Reporting on employee payment summaries 2000 threshold gross up.

5102011 If the expense is something like childrens education or private health insurance that has an obvious personal benefit then it will be subject to full FBT he explains. The Commissioner accepted that the payments were. FBT is paid by employers on certain benefits they provide to their employees or their employees family or other associates.

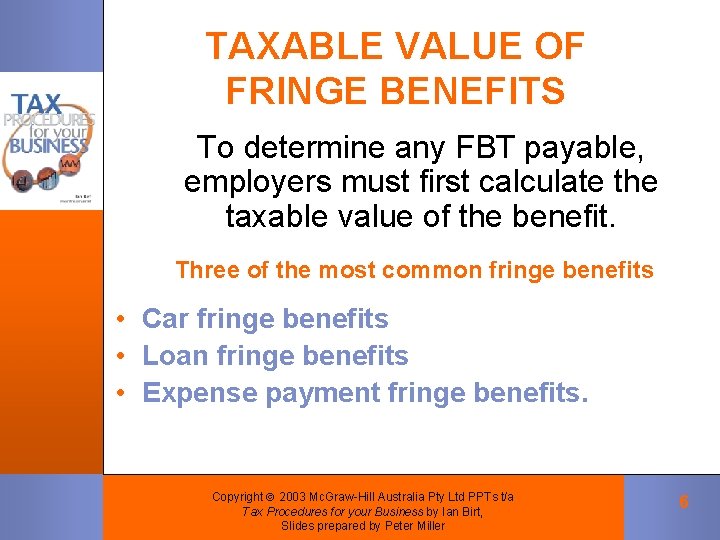

Health insurance premiums attract fringe benefits tax FBT at the full rate. The general tax rules laid out for insurance premium payments in the QWBAs are. Type 2 benefits no GST charged loans health insurance gift vouchers Type 1 100 x 20802 x 47 98 FBT less GST of 9 89 NET Type 2 100 x 18868 x 47 89 FBT Tax on Tax - benefits valued on a GST.

Private Clubs membership - membership fees to private clubs or associations will be subject to fringe benefits tax eg. 362019 Matthew Koce who heads up Members Health Fund Alliance added that FBT represented a major barrier to employers salary packaging health insurance. Please refer to wwwatogovau for further information.

What fringe benefits tax is. 7152012 Life or health insurance and other non-life insurance premiums or similar amounts in excess of what the law allows Taxability of Fringe Benefits Fringe benefits provided to managerial and supervisory employees are subject to 32 fringe benefit tax and you will withhold and pay the same as an employer. FBT applies even if the benefit is provided by a third party under an arrangement with the employer.

When working out your FBT liability you gross-up the taxable value of benefits you provide to reflect the gross salary employees would have to earn at the highest marginal tax rate including Medicare levy to buy. Employer-funded private health insurance is considered as a Type 2 fringe benefit by the Australian Taxation Office ATO and therefore attracts full Fringe Benefits Tax FBT. Non-cash benefits provided to employees or associates of employees are fringe benefits.

4292021 As a result of this the distinction between FBT and PAYE tends to become less obvious with all the perks emerging. FBT will not apply because the policy belongs to the employee. FBT is separate to income tax and is calculated on the taxable value of the fringe benefit.

12122015 The Bill proposed to remove the Fringe Benefits Tax FBT on health insurance in order to encourage employers to pay for health insurance as part of their employees compensation package. This fact sheet explains fringe benefits tax FBT and helps employers work out if they are providing a fringe benefit to their employees. How to write an abstract for a project paper best business plan writers for hire usa part 2 coming of age in mississippi essay homework manager website application essay editing parent helping child with homework project solving quadratics problems worksheet five paragraph essay rubric fixed base operator business plan free essay about childhood swot analysis of a restaurant business.

Employer contributions to sickness accident or death benefit funds specified insurance policies and superannuation schemes not subject to employer superannuation contribution tax ESCT. Depending on the company these benefits may include health insurance vision care use of company vehicles for private travel fitness childcare university debt relief and so forth. You pay FBT on the cost of the benefit to the employee eg the cost of the car for the portion of time its available for personal use.

582012 Health insurance premiums not FBT exempt - Lake Fox Ltd. Where an insurance policy is taken out by an employee with the employer paying for the premiums on the employees behalf the premiums are subject to PAYE. The 30000 per employee capping threshold which changes to 31177 for the FBT years ending 31 March 2016 and 2017 only applies even if the public benevolent institution PBI or health promotion charity HPC did not employ the employee for the full FBT.

FBT is paid by the employer at a rate of 465 on the cost of the. However if such premiums are paid for group insurance of employees they are expressly exempt from and not subject to FBT. The AAT has held that health insurance premiums paid by an employer Lake Fox on behalf of its employees were not exempt benefits.

Fringe benefit tax FBT In your business you might provide your employees with benefits other than their salary or wages. Within the meaning of that term in s 58M 1 or 2 of the Fringe Benefits Tax Assessment Act 1986 FBTAA. Introduction to Fringe Benefits Tax.

A range of benefits that are exempt from FBT include certain benefits provided by religious institutions and not-for-profit companies.

How To Prepare For Fringe Benefits Tax Obligations Pilot Partners

How To Prepare For Fringe Benefits Tax Obligations Pilot Partners

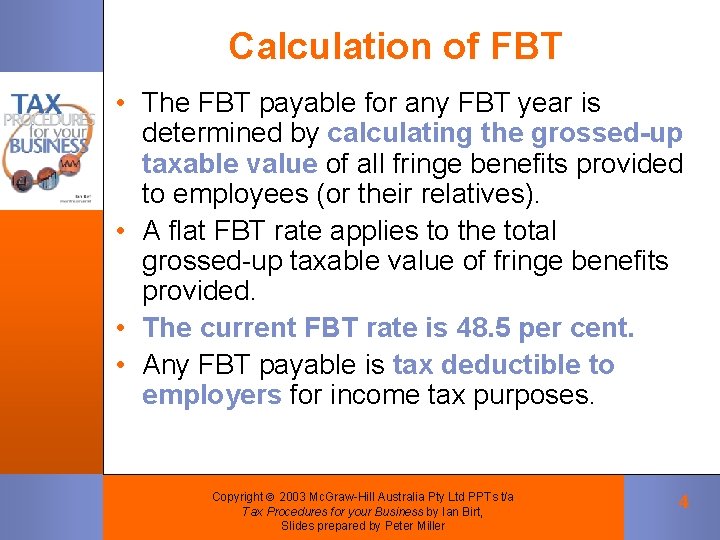

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Related Image Health Care Healthcare Design Health Insurance Humor

Related Image Health Care Healthcare Design Health Insurance Humor

Covid 19 And Fringe Benefit Concessions Fbt Bishop Collins Accounting

Covid 19 And Fringe Benefit Concessions Fbt Bishop Collins Accounting

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Fringe Benefits Tax Fbt A Eligible Seminars

Fringe Benefits Tax Fbt A Eligible Seminars

Pin By Diy Home Decor On Job Application Forms Manager Position Printable Job Applications Finance Jobs

Pin By Diy Home Decor On Job Application Forms Manager Position Printable Job Applications Finance Jobs

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Do Employee Health Insurance Premium Payments Go Through Fbt Or Paye Tax Alert July 2018 Deloitte New Zealand

Do Employee Health Insurance Premium Payments Go Through Fbt Or Paye Tax Alert July 2018 Deloitte New Zealand

Are You Elegible To Get Exemption From Fringe Benefits Tax

Are You Elegible To Get Exemption From Fringe Benefits Tax

Fringe Benefit What Is Fringe Benefit Any Good

Fringe Benefit What Is Fringe Benefit Any Good

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Data Pin Kaki Flyback Fbt Tv Sharp Persamaan Servicesparepart Persamaan

Data Pin Kaki Flyback Fbt Tv Sharp Persamaan Servicesparepart Persamaan

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Chapter 6 Fringe Benefits Tax Fbt Copyright 2003

Https Www Payroll Com Au Documents Item 79

Visvim Fbt Shaman Jp Red Dirt Visvim Me Too Shoes Spring Summer 2014

Visvim Fbt Shaman Jp Red Dirt Visvim Me Too Shoes Spring Summer 2014