Health Fsa Limits 2013

Off-calendar plan years do not have to change health FSA limits for years starting in 2012. 1192020 If a single employer has both a limited-purpose and a general-purpose health FSA the maximum contribution limit is shared between the two FSAs.

Free 23 Insurance Verification Forms In Pdf Dental Benefits Dental Insurance Dental Office Management

Free 23 Insurance Verification Forms In Pdf Dental Benefits Dental Insurance Dental Office Management

The maximum by law you will be able to contribute as of 2013 will be 2500.

Health fsa limits 2013. Instead the IRS has clarified that the limit applies on a plan year basis and is effective for plan years beginning after Dec. Simply that health FSAs can include employer contributions of 500 or up to a dollar for dollar match of each participants election. The new IRS notice clarifies that the 2500 Limit Rule applies for plan years beginning on or after January 1 2013.

HSA contributions from all sources cannot exceed certain annual limits prescribed by the IRS and adjusted annually for inflation. In 2013 new limits on flexible savings accounts take effect with health care reform legislation. Employees divert pre-tax salary into these.

In addition the health FSA must limit the maximum payable to 2 times the participants salary reduction or if greater the participants salary reduction plus 500. Employers commonly limit FSA contributions to 5000 per year or less. 125 cafeteria plan limits each employees salary reduction contribution to the health FSA to no more than 2500 per taxable year as indexed for.

Health FSA Rollover Maximum. This represents the maximum amount that can be carried over from the previous year into the year listed on the right. The health FSA contribution limit originally imposed by the Affordable Care Act ACA and set at 2500 adjusts in 50 increments based on a complex cost-of-living calculation.

Nuts and Bolts a The 2500 limit applies only to. In 2013 the IRS in Notice 2013-71 provided that a cafeteria plan with a flexible spending account could provide for a carryover of up to 500 into the following year reducing the impact of the use it or lose it rule when an employee who deferred more to the account than heshe incurred in medical expenses for a year would forfeit the extra. Treasury Department and the IRS issued a notice and fact.

Effective January 1 2013 the Patient Protection and Affordable Care Act PPACA essentially further explanation needed required flexible spending accounts to limit employees annual elections to no more than 2500 with small increases each year based on inflation. IRS Allows 500 Annual Carryover for Health FSAs On Oct. Thus for a calendar year plan the limit will become effective on Jan.

In addition the notice allows employers to wait until the end of 2014 before amending their Health FSA plan document to reflect this change although employers may want to act before then. Ad Full Body Comprehensive CT Scan Based in Maryland. The IRS Notice states that the 2500 health FSA limit does NOT apply for plan years that begin before 2013.

1 2013 for most employees there is a new 2500 cap on healthcare flexible spending accounts. Section 125i provides that beginning in 2013 a health FSA is not treated as a qualified benefit unless the. What does this mean.

January 1 2013 must adhere to a health FSA maximum benefit limit of 2500. Ad Full Body Comprehensive CT Scan Based in Maryland. Currently theres no such limit for health care FSAs.

Whether an individual is enrolled in self-only coverage or coverage that includes any other individuals does not impact the maximum annual contribution under a health FSA. That is 2500 is the maximum amount that an employee may contribute in 2013 regardless of the number of individuals eg spouse or dependents whose medical. Beginning in 2013 the amount that a participating employee can contribute to an FSA for health care expenses is limited to 2500 thereafter indexed for inflation.

4232013 The new health FSA limit applies on an employee-by-employee basis. 5122020 Health FSA Carryover Rule. HSA Annual Contribution Maximum.

Plans with start dates after January 1 will begin the 2500 limit with their first plan year that begins after January 1 2013. 31 2013 the US. 11162012 Under ObamaCare starting with the 2013 plan year Jan.

The History Milestones Of Alibaba Group Infographic Infographic History Timeline Infographic

The History Milestones Of Alibaba Group Infographic Infographic History Timeline Infographic

11 Overlooked Aspects Of A Health Insurance Plan As A Consumer It Is Vital That You Read Health Insurance Plans Health Insurance Health Insurance Benefits

11 Overlooked Aspects Of A Health Insurance Plan As A Consumer It Is Vital That You Read Health Insurance Plans Health Insurance Health Insurance Benefits

Updates To Section 125 Plans Cafeteria Plans Youtube

Updates To Section 125 Plans Cafeteria Plans Youtube

05 19 05 25 Cvs Couponing Summers Eve Cvs

05 19 05 25 Cvs Couponing Summers Eve Cvs

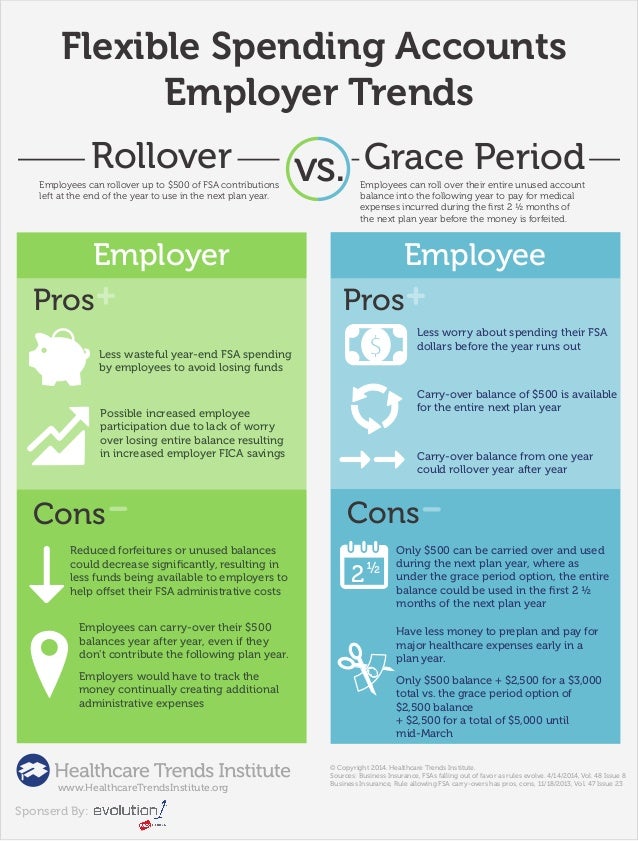

To Rollover Or Not To Rollover Pros And Cons Of Fsa Employer Trends

To Rollover Or Not To Rollover Pros And Cons Of Fsa Employer Trends

Infographics Health Insurance Infographics Infographic Health Health Insurance Medical Insurance

Infographics Health Insurance Infographics Infographic Health Health Insurance Medical Insurance

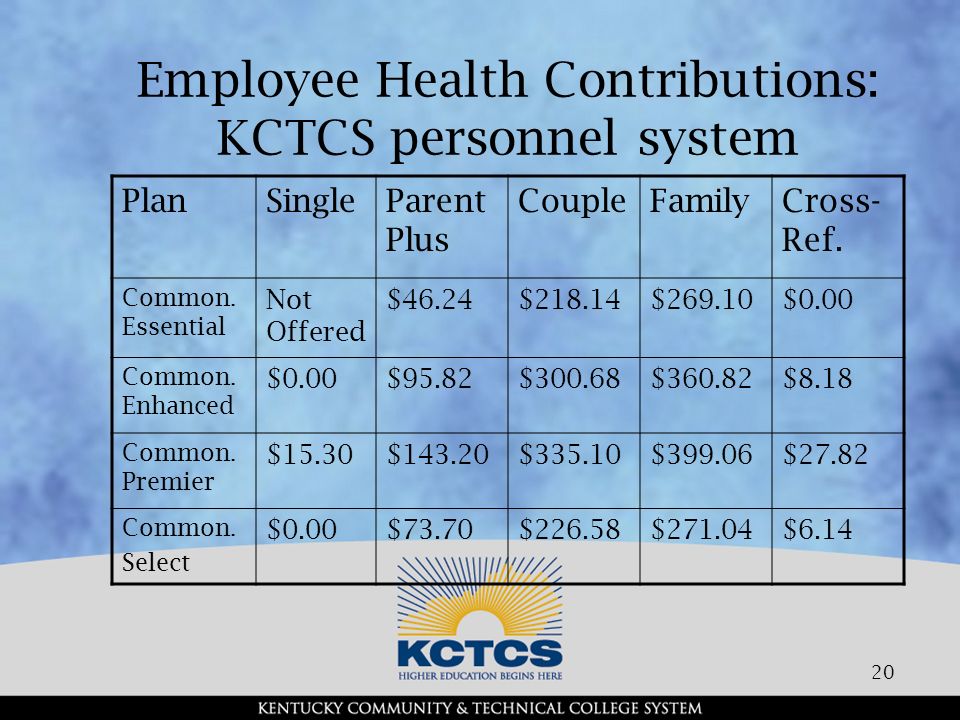

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

June 2020 Benefits Bulletin 2021 Hsa And Hdhp Limits Ibtx Insurance

June 2020 Benefits Bulletin 2021 Hsa And Hdhp Limits Ibtx Insurance

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Free Annual Credit Report Website Finance Gourmet Free Annual Credit Report Annual Credit Report Finance

Free Annual Credit Report Website Finance Gourmet Free Annual Credit Report Annual Credit Report Finance

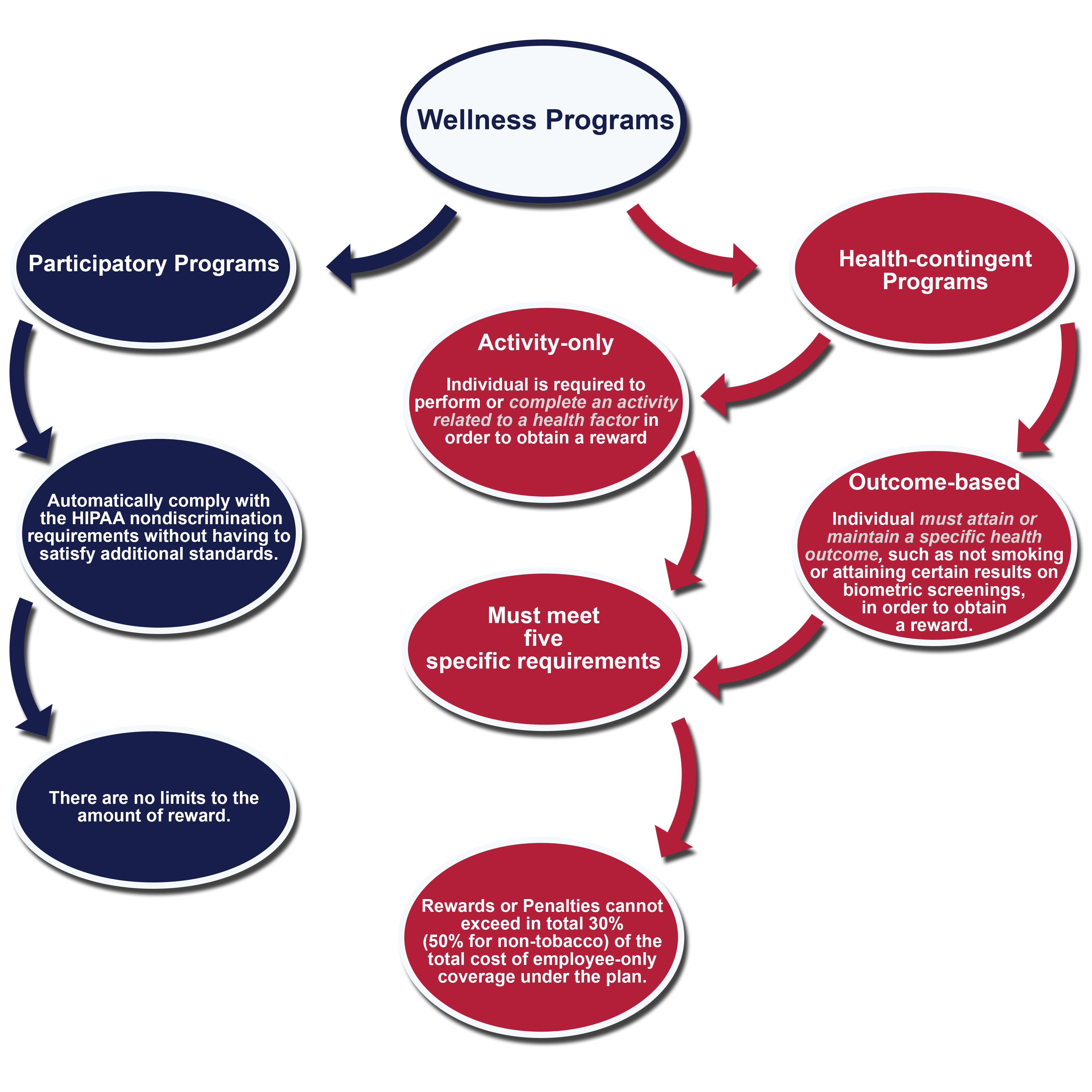

Final Hipaa Non Discrimination Regulations For Wellness Programs Henderson Brothers

Final Hipaa Non Discrimination Regulations For Wellness Programs Henderson Brothers

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Infographic Employers Are You Ready For Health Care Reform Health Care Reform Health Insurance Health Care

Infographic Employers Are You Ready For Health Care Reform Health Care Reform Health Insurance Health Care

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download

Open Enrollment Plan Year Today S Agenda Open Enrollment Health Care Web Enrollment Health Health Contributions Employee Resources Wellness Dental Ppt Download